Insurance referral programs are a powerful marketing tactic for all types of insurance agencies to scale their growth. Aside from generating new business, insurance referral programs are also a great way to encourage and track your agency’s word of mouth.

In this article, we cover why your insurance agency needs a referral program, best practices when creating your own insurance referral program, plus practical examples of how these referral marketing strategies have been used by real-world insurance companies.

What is an insurance referral program?

An insurance referral program encourages your clients to share your insurance agency with their peers, and then rewards them with an incentive for each peer who becomes your client. When done right, an insurance referral program helps you bring in new clients, gives you instant visibility on where your referrals come from, and scales your insurance agency’s growth.

Why do you need an insurance referral program?

An insurance referral program is a low-cost yet effective way to get promising new leads for your insurance agency.

Developing an effective insurance referral program requires strategic thought, creative referral ideas, and a little bit of work. But the results can be well worth it.

There are many reasons why you should consider an insurance referral program.

- Referrals can help reduce your customer acquisition costs. You are leveraging your existing customer base to refer leads to you, and their word of mouth is practically free.

- Referral programs make it easier for customers to share information about your insurance agency and more motivating thanks to offered incentives.

- Even if customers are satisfied with your agency, they may need an extra push before they refer new business to you. Not every devoted client is going to refer leads on their own otherwise. Your referral program incentive creates the needed motivation.

- Referred leads have a higher chance of becoming customers compared to other leads because they trust their peer’s recommendations far more than traditional ads.

- Research points out a whopping 92% of global consumers trust earned media over other ads. This includes reviews or word-of-mouth recommendations from friends and family.

- People with similar backgrounds, tastes, and lifestyles tend to make similar choices.

- Insurance referral programs can be applied to any form of insurance with the same potentially great results. This includes life insurance, home insurance, auto insurance, business insurance, and real estate insurance, among many other types.

- Referred customers are more likely to bundle multiple types of insurance coverage (if you offer them). For instance, they might start off wanting life insurance. But while talking to them, you may be able to show them the benefits of taking homeowners’ insurance or auto insurance as well. Because they trust their friend’s recommendation of your agency, they may be willing to make more of an investment in you.

- Referred customers are more likely to remain your customers for longer periods, giving them a higher customer lifetime value. Again, that happens because they trust their friend’s recommendation.

- Customers who recommend you to their friends also develop a stronger relationship with you, as they become more invested in your success.

- Insurance referral programs let you easily track every referral your customers make, and use the data you collect about your program to improve your success. It’s pointless to have a referral program without any means to measure how it’s doing. For example, tracking allows you to find your best sources of lead generation, whether it’s specific individuals or your social media channels.

- Referral programs let you accelerate the growth of your agency and effectively scale. Done right, you will get exponentially more leads for potential customers over time.

Before you start an insurance referral program

There are a couple of things to consider before you develop and start your own insurance referral program. Think of your program as a machine with many different moving parts that need to work together in order to run efficiently.

Make sure you have stellar customer service

Nothing sells quite like customer service, especially in insurance.

Customer service is uniquely important for insurance sales because most insurance products in the same space (i.e., automobile, home) are relatively similar. The customer experience is actually the biggest differentiating factor.

You’ll need to provide a stellar experience to convince a customer to buy and stay with your business.

And having a strong base of customers is essential to referral program success. For insurance agents, customer experience is probably the most important reason why customers will want to recommend you.

Know your customers

Knowing your existing customers goes a long way in getting more new referrals. It’s a bit like ears-to-the-ground market research. You should answer the following questions about your clients:

- How do they get information about your insurance agency? From who or where did your current customers learn about your agency and services? This gives you an idea of channels that you could explore further, to promote your referral program.

- How do they communicate with friends? Find out their preferred channels and use the same channels for sharing in your referral program. This helps them easily refer others in those same channels.

- What motivated them to purchase insurance from you vs. a competitor? This is your USP (Unique Selling Point). Your USP is usually an advantage that’s unique to you and helps set you apart from the competition

- What rewards would motivate them to share with peers, friends, or family members? Information like this can help you develop referral rewards your current clients would be motivated to earn.

Know how much it usually costs to acquire a new customer

Customer acquisition costs are helpful for business owners to understand the difference between how much you’re earning from your customer vs. how much you’re spending to gain the customer.

This customer acquisition cost will help you determine how much you want to reward for referrals.

This may be a no-brainer, but at no time should your referral rewards eat so much into your budget that the program is no longer profitable. Your customer acquisition cost shouldn’t be more than the profit you’re generating from your customer.

Determine which customers you should promote your program to first

Look for customers who are likely to be enthusiastic about testing your program.

- Who have been loyal customers the longest? If you’ve been keeping in touch with the customers and have a long-standing relationship to fall back on, they could be potential first picks.

- Use NPS (Net Promoter Score) surveys to see who is most likely to promote you. An NPS survey is used to measure customer satisfaction by asking how likely a customer is to refer clients to your insurance agency. Focus on the customers who love you the most. These are your “promoters,” or those who receive a score of 9 or 10 on the NPS scale.

- Find out if some customers have already referred friends to your agency, without prompting. These are potentially your brightest superstars. They’re happy customers who are eager to share the news with others in their circle.

Know the laws that govern insurance referrals in your area

Your insurance agency referral program can be affected by laws specific to your area.

In the US, the laws that govern insurance referral programs can vary from state to state. Searching online can help you get an idea about the basics.

But it’s also recommended to get advice from legal experts. You don’t want to end up breaking the law simply for not knowing about it.

A basic example of one such legal concept is when you reward your customers with a ‘finder’s fee,’ say in the form of cash, gift cards, or credit towards a policy. Sometimes, you are only allowed to do this as long as you don’t reward other licensed insurance agents for referrals.

Best practices for insurance referral programs

Before you develop your referral rewards programs, factor in these tried-and-tested referral strategies to enhance your offerings and get the best results.

Offer valuable rewards for referrals

Rewards motivate existing customers to refer their friends. Do the initial market research to find out what types of referral rewards will genuinely entice your customers. You don’t want to end up with a referral rewards program no one participates in.

- Cash, gift cards, and discounts are seen to be the most motivating insurance referral rewards for your current clients.

- Cash works for customers who love monetary incentives and immediate gratification.

- Gift cards and discounts on premiums can be motivating for practical-minded customers who are looking for things to make their lives easier or better.

- Cash, a discount on a later premium payment, or a gift card are effective rewards for new customers.

It’s always best to reward both the referring customer and the new customer, with a “double-sided” reward structure.

This strategy goes a long way to generating customer referrals for life. Of course, you’ll need to ensure that referral rewards like these are legal in your state or region.

Even better? Offer tiered rewards, where the incentive increases in value after someone makes a certain number of successful referrals. So, as the number of referrals increases, so does the value of the incentives for your clients.

A tiered rewards structure can be a highly motivating incentive for your customers to sign up for your insurance agency referral program.

Promote your program in a variety of ways

After you build your program, it’s time to start promoting it. Customers need to know the program exists so they can share it and earn rewards.

Here are a few ways you can promote your referral program:

- Highlight information about our program on your website. Make sure it’s easy to find and located in a prominent position on your website. For instance, you could add a hero image or a banner on your homepage. You could also do referral buttons on your top and bottom menus leading the user to more information on your program.

- Develop email sequences focused exclusively on your referral program. Avoid bombarding your clients with emails by turning them off in the process. And remember to send promotional emails only after you’ve sent emails providing value and sharing helpful resources first. It’s a delicate balance, so err on the side of caution.

- Add a promotional section for your referral program in a clearly visible section of your email newsletters.

- Add a promotional link at the bottom of your email signatures. It’s a more discrete method of marketing, but it can still help you cover all the bases.

- Share information about your referral program across all your social media accounts.

- If you have a customer portal, remember to add links or highlighted sections that talk about your referral program on the portal too.

- Don’t be afraid to ask for referrals in direct conversations with customers.

For example, after someone has been a customer for a year, you might personally remind them of your referral program every six months.

Keep track of how often you use these direct reminders, though, so you don’t annoy a customer.

Make your program easy to use and understand

Clients often have short attention spans when browsing online. Once you have their attention, you want them to complete the action of referring someone to you before they leave the site.

Make your referral recommendation process simple, or your customers will just leave and go elsewhere.

- The golden rule is for your clients to refer a friend in the least number of clicks or taps possible. Avoid rerouting to another page where customers have to fill up yet another form.

- Give your customers flexibility in how they make referrals. Customers should have multiple options for sharing, including social media channels, email, and/or a unique referral link that can be shared almost anywhere.

- Customers should know exactly what you want them to do when they skim your referral landing page. Do they know where and how they need to submit the referrals? Do they know they have options for how to share it with friends?

- Lay out all the benefits clearly so customers know exactly what’s in it for them. Insurance companies, in particular, promote the intrinsic benefit of helping a friend get access to great insurance.

A referral call to action is key to accomplishing this. We’ve created a comprehensive guide that shows you exactly how to create effective referral call-to-action buttons.

Pro tip: Create a referral FAQ page that outlines program terms and common concerns, to eliminate other obstacles that may keep people from referring friends.

- The best FAQs address all the possible questions that your customer may have about joining the program.

- Stick to simple and easy-to-read and understand responses.

- Avoid making the FAQs too wordy or too detailed.

Write notes of appreciation for successful referrals

Human nature thrives on appreciation. Sometimes we can do things for others without expecting anything in return. But we always feel validated and valued when someone appreciates what we’ve done for them. It’s a great concept to apply in insurance referral programs.

- Publicly thank customers who referred their friends in your email newsletters and social media accounts, when their friends sign on to become customers.

- Privately recognize these successful referrals as well – send thank-you notes to existing customers when their friends become your new customers.

This gift might encourage others at the business to make referrals as well. It shows quite simply how much you appreciate your clients’ support.

Use referral software to track, manage, and automate your program

As you grow your agency and business starts to flow in, you may find your manual tracking methods no longer work very well.

Manual tracking can also be inefficient if you have more than one business or insurance type on your plate.

This is where referral marketing software comes in. The right referral software streamlines your program creation process and removes the hassle of manually managing your referral rewards program.

Automation features can help you save time. You can set up manual tasks to run repetitively on their own, and spend more time on the more crucial task of converting leads to customers.

Thanks to the referral links it generates, referral software lets you track exactly where every referral came from and instantly issue rewards for successful referrals.

You won’t need to track and trace every single referral and make sure they’ve been paid. This feature can be a huge benefit as you start to scale.

Referral software also collects program data used to measure success and refine your program structure.

Knowing where the kinks are in your strategy can help you figure out how to set things right. You’ll also learn which of your strategies are really moving the needle, so you can focus on replicating or scaling them.

Customize your program and take advantage of automated tracking and promotional features.

Read more about how our referral program software can benefit your business.

Insurance referral program examples

Now that we’ve covered the most important aspects of developing your own insurance referral program, let’s look at some real-life case examples. We’ve hunted down 5 clear examples from the insurance industry that show you how to practically apply the strategies that we’ve just explained.

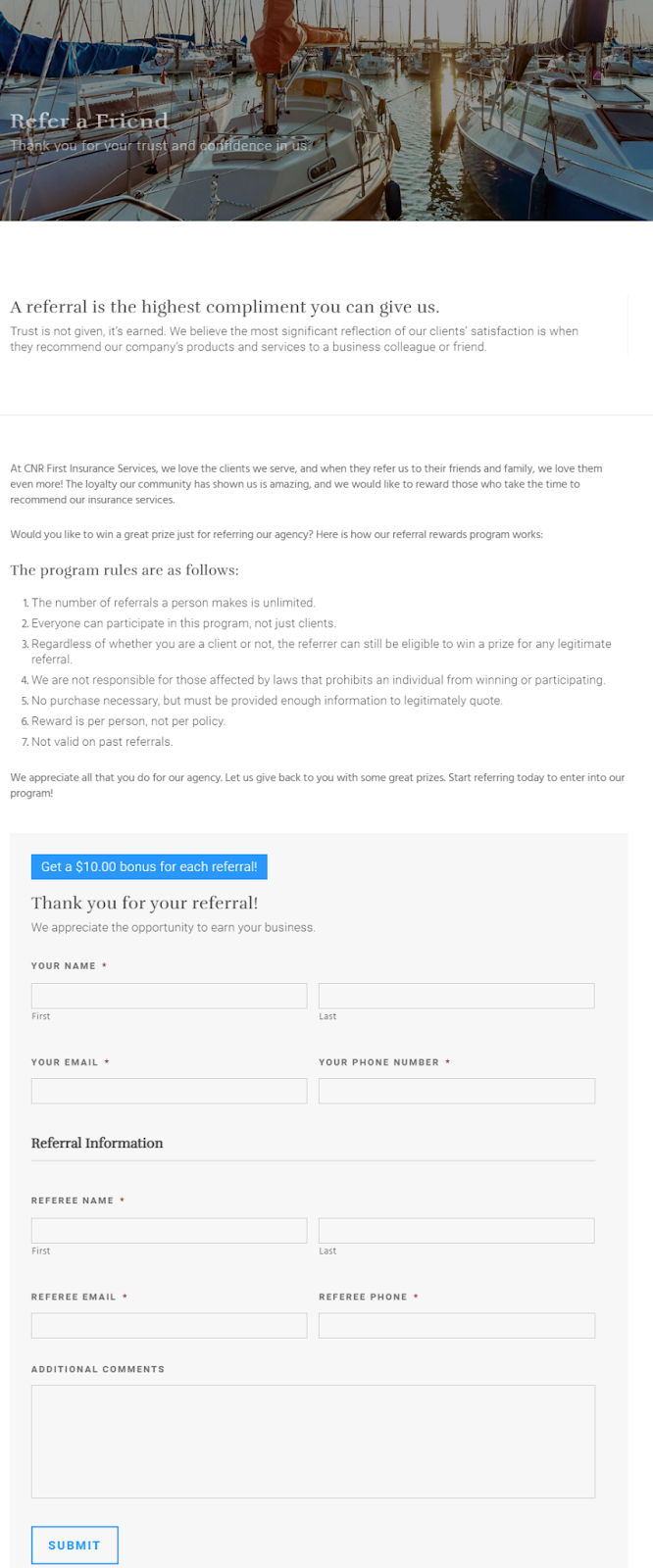

1. CNR Insurance

CNR Insurance has a simple, elegant, but effective landing page for promoting their referral program. To pull you into the referral program page, they’ve used a bright blue button on the right side of every page where it’s easily seen. The button itself is titled simply ‘Refer a friend.’

The company showcases commitment to their customers and cleverly alludes to the loyalty they’ve received as a result of it – a nod to what appears to be stellar customer service. The program itself is laid out without much fluff, emphasizing how simple and easy it is.

The rules for the referral rewards program are brief and easy to understand straight away.

CNR Insurance has chosen to use a form where visitors can quickly input all the necessary information required. Visitors are then directed to call a phone number or use another contact form (if preferred) to follow up.

CNR Insurance’s referral program is a great example of how to woo customers on your website without any fancy tools. Placement and simplicity can work just as effectively.

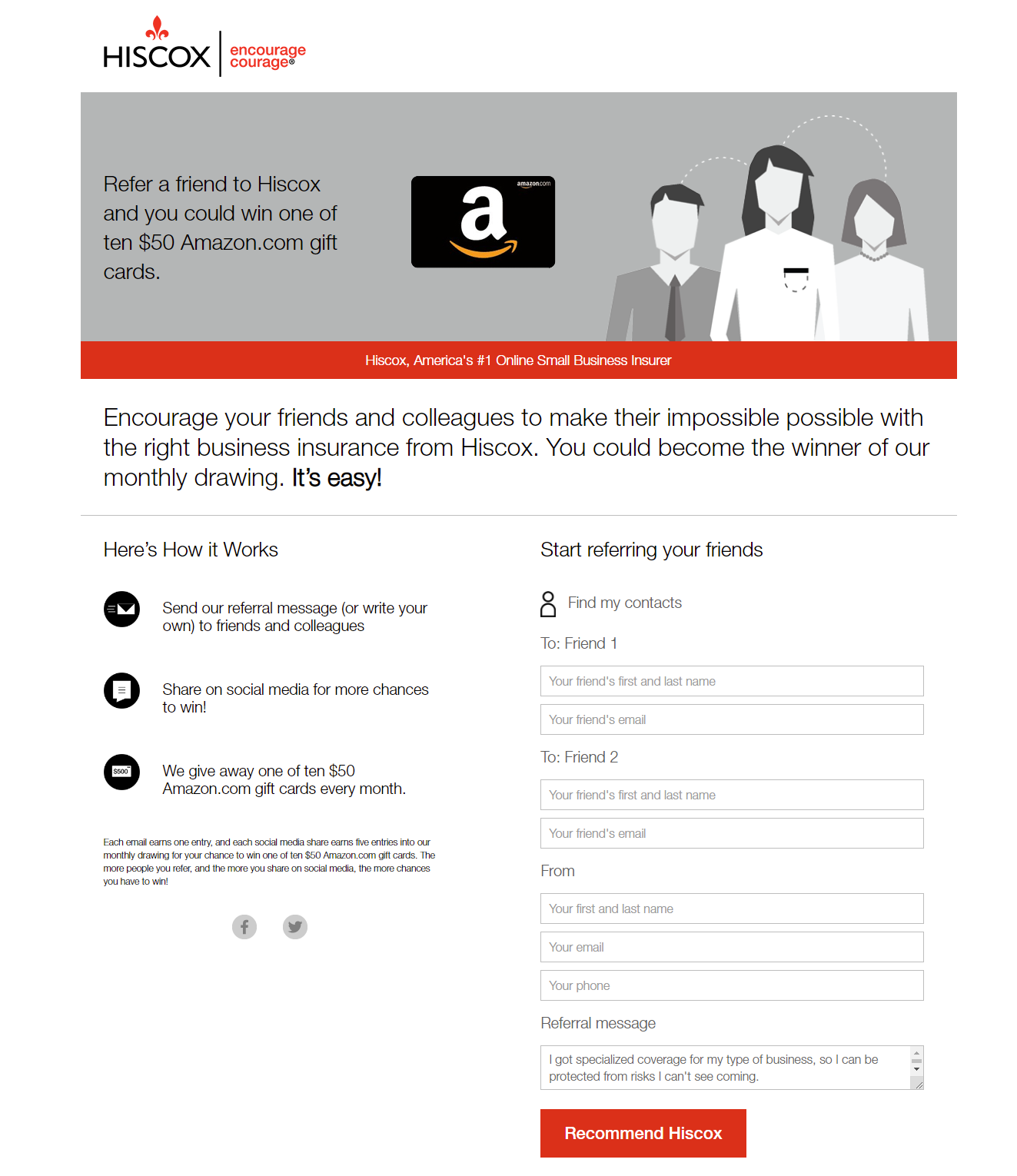

2. Hiscox

Hiscox is an example of how to grab a customer’s attention straight off the bat with a benefits statement placed front. ‘Refer a friend to Hiscox and you could win one of ten $50 Amazon.com gift cards.’ is hard to resist or miss!

The benefits statement is followed up with a brief explanation of how the program works.

While Hiscox doesn’t give a guaranteed reward for each referral, it offers the possibility of winning in a very convincing way. The brand has also used a contact form for the visitor to easily send referral information – including a space for the customer to personalize a message to their peer.

Needless to say, the brand doesn’t have to spend anything for the mentions on social media – which is a great way to also get more exposure for their program.

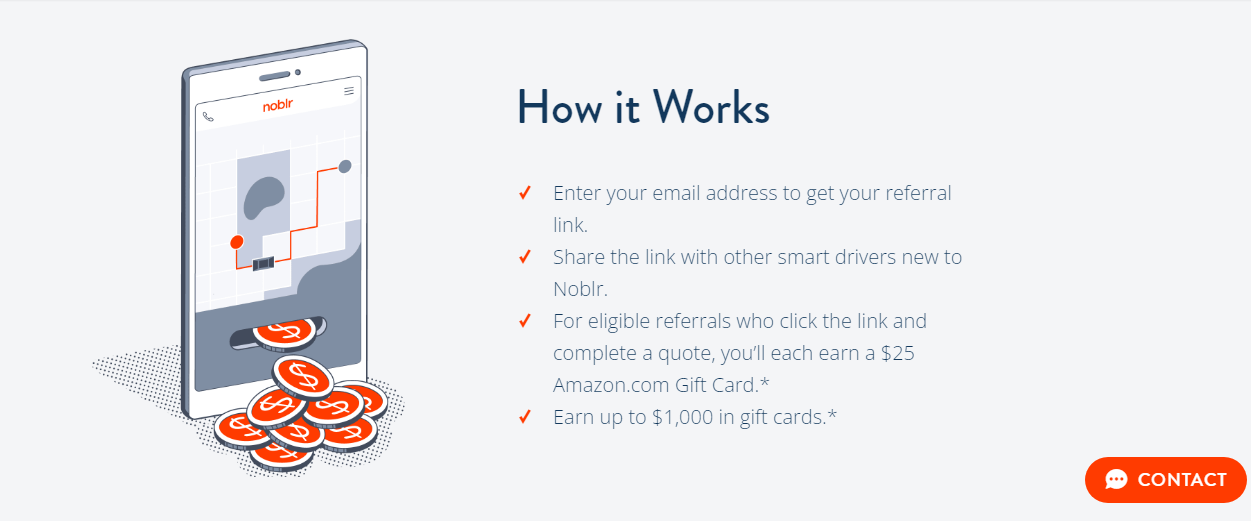

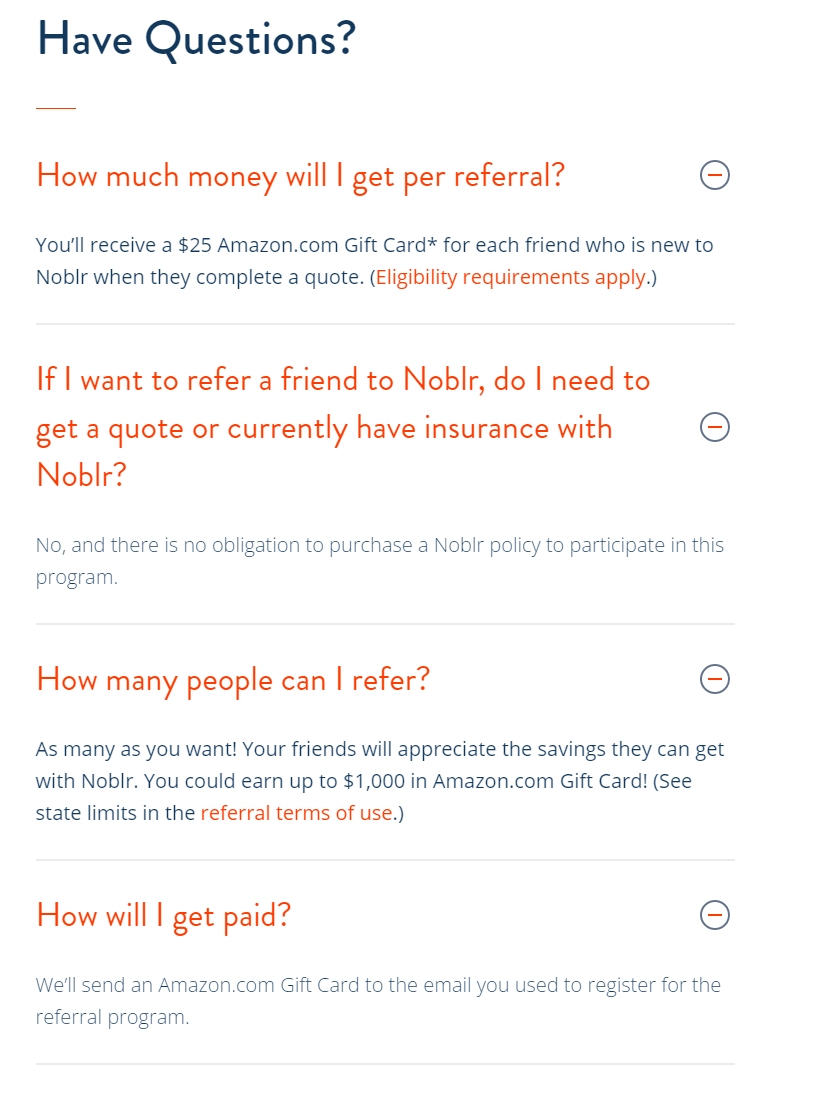

3. Noblr

Noblr has relied on a prominent placement and centralized design structure to capture interest in the referral program.

Placing your content on the center of the page makes it easy for the visitor to read and scroll through content. Their eyes are not forced to go back and forth in different directions, which can be a distraction.

Noblr has adopted possibly the most customer-friendly approach to getting referrals by adopting the link method. All the customer has to do is type out their email address and click the ‘generate link’ button to get a shareable link which can be copied and pasted anywhere. You can also use their Facebook button to share the same link directly to Facebook.

Noblr has also listed the benefits of the program on the main page and added an FAQ section to address commonly asked questions.

You’ll also see a clickable call-to-action on the bar right at the top of the website page which says, “Refer-a-Friend and earn $25 for each friend who gets a quote!”

Noblr has effectively made use of the available space on the page for promoting the program without inundating the visitor with over-promotion.

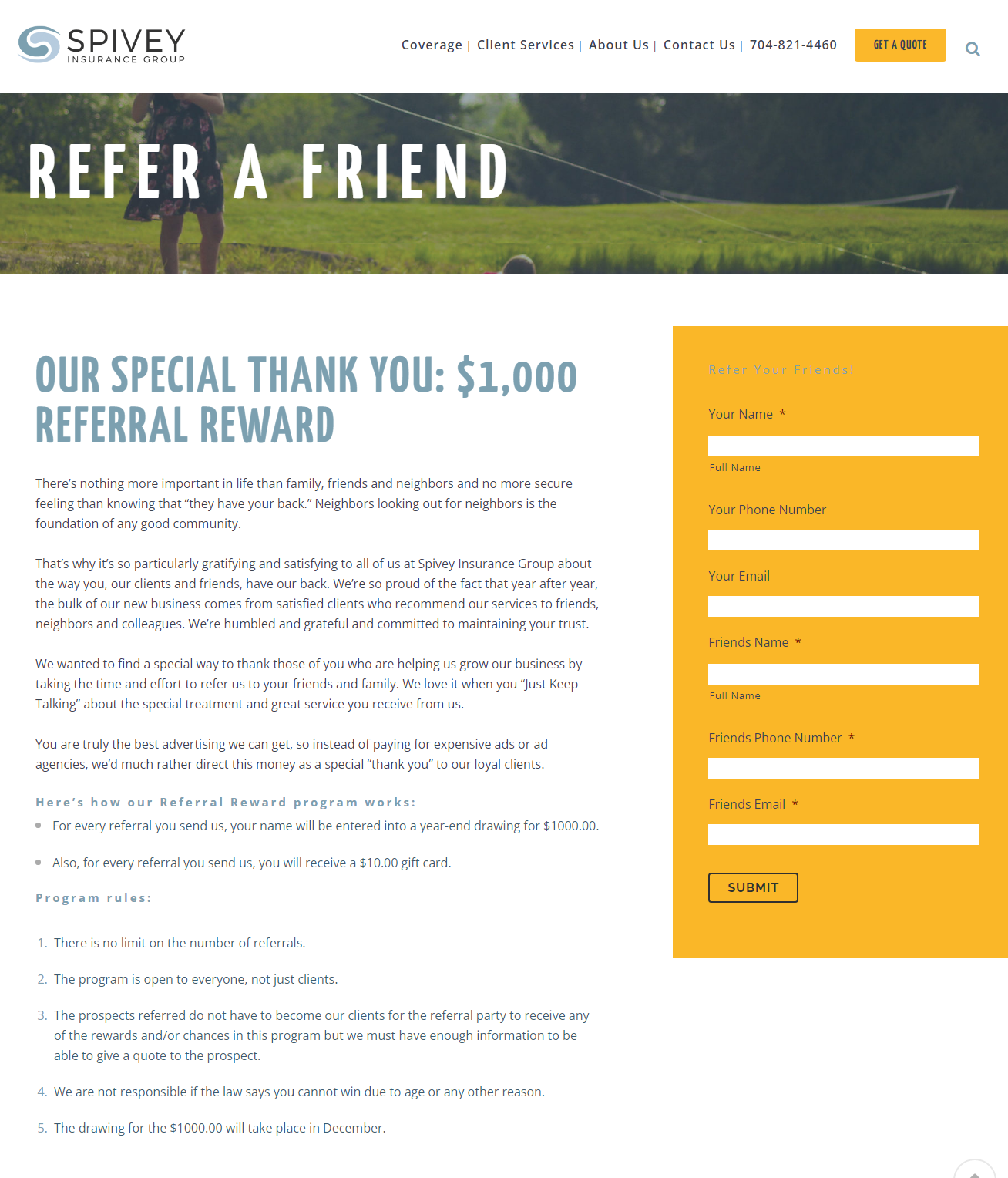

4. Spivey Insurance Group

Spivey’s landing page is similar in structure to that of CNR Insurance, but with an additional incentive of possibly winning $1,000 in a draw slated for end-of-the-year. This is on top of the guaranteed $10 per referral scheme.

Spivey has also emphasized customer goodwill, together with a sense of community, to link positive feelings with the brand. In a bid to simplify the referral process, they’ve used a form where visitors can fill up all the details needed to refer a friend, peer, or family member.

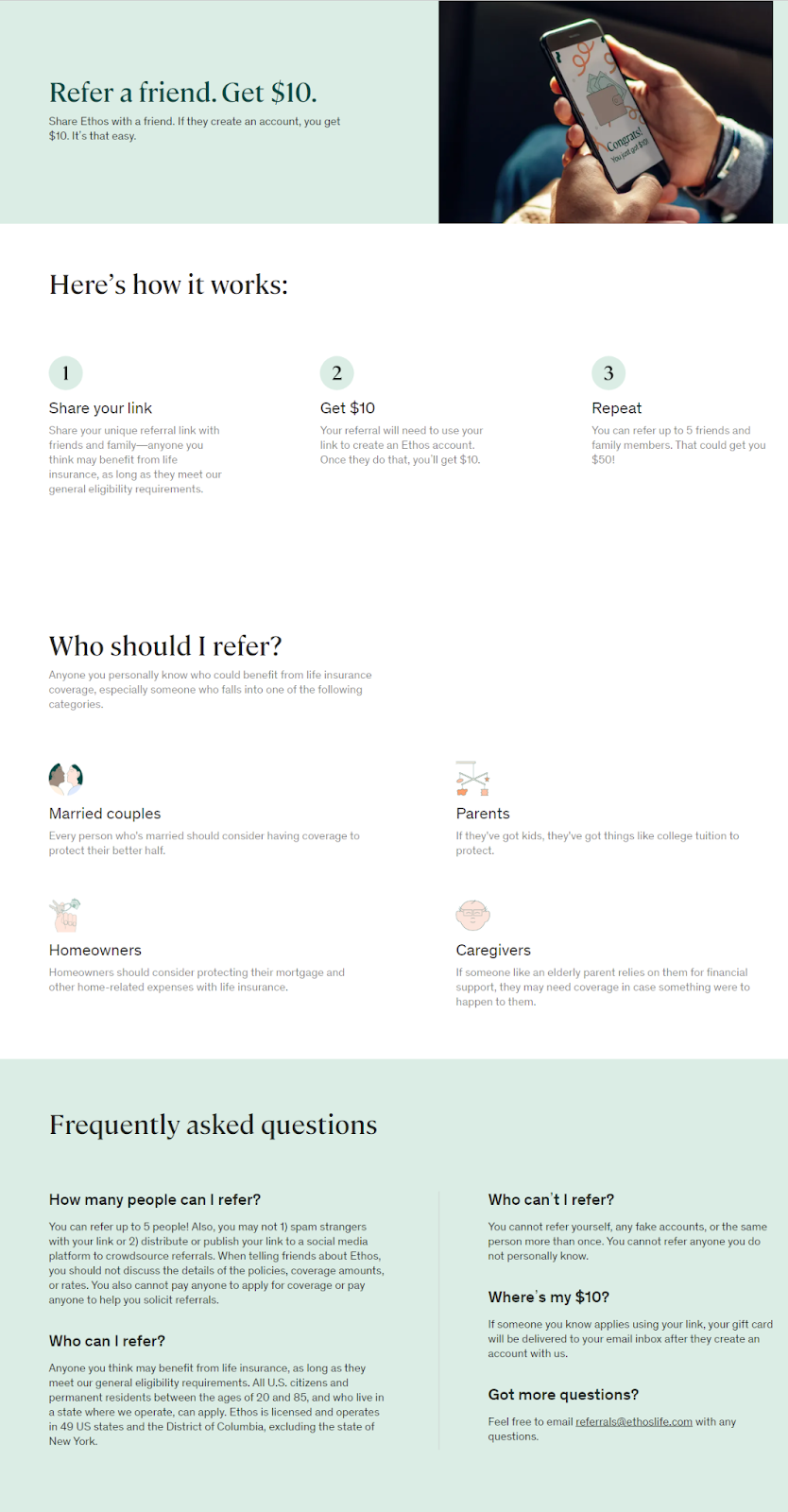

5. Ethos

Ethos has adopted a clean design choosing to emphasize how simple it is to make referrals on their program. The 1-2-3 step process of making referrals displayed on the site reflects that it only takes three easy steps to make a referral. That’s a great way to capture the interest of time-starved visitors who don’t want a run-around.

Ethos also breaks up content section-wise, varying background colors to sustain interest. You only need to type an email address and click the continue to get started.

Also available on the same page are details of who you can refer, FAQs, plus a section devoted to the fine print visitors need to be aware of.

Conclusion

Insurance referral programs can be a game-changer if you want to take your business to the next level.

Do market research on the types of rewards your customers will appreciate the most and factor these into your reward programs. Promote your program across all your sales channels. Make use of NPS surveys to see how you’re doing, and to make changes if needed based on feedback. And of course, make sure you’ve chosen the right referral software to maintain your program!

Aside from having a great program, the success of the insurance referral program can rest heavily on how great your customer service and relationship skills are. Appreciate your clients and focus on the relationship so your customers are just as vested in helping you grow your business.