We hear so many success stories of companies that have used referral programs:

- Dropbox’s SaaS referral program resulted in four million users in 15 months and increased sign-ups by 60%.

- Paypal’s referral program increased daily growth by 7–10%, resulting in a user database of over 100 million.

- Catapult’s program generated over 4,500 referrals in the first six months

- Coolbot’s referral program resulted in 10 times the ROI in just a few months.

The reasons why you need a referral program are evident: thanks to trusted recommendations, referral programs bring in paying customers who are more likely to stick with you.

But how do you measure your referral program’s performance to gather accurate results? In other words, how do you calculate referral program ROI (return on investment)?

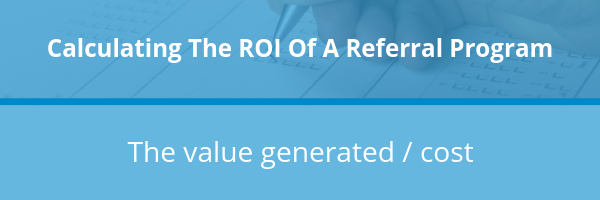

A simple way to think about referral marketing ROI is in terms of costs and revenue: how much you have spent vs. the revenue generated from referred customers. If your program’s sales revenue is higher than your spend, then your ROI is positive. Here’s how to calculate referral program ROI, to know how worth it your investment is.

How to calculate referral program ROI

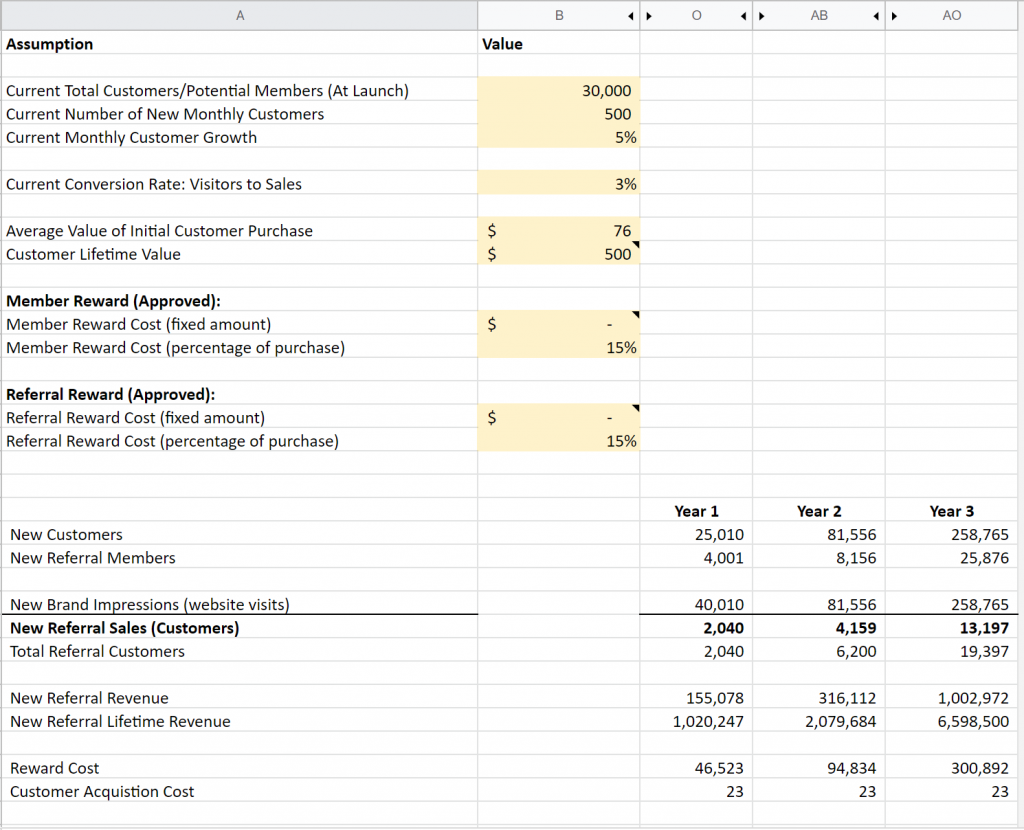

You can use our spreadsheet calculator to easily calculate your referral marketing ROI. After inputting your customer data, you can see the projected ROI that a customer referral program or partner referral program can bring to your business.

Now, let’s go over some of the essential elements you need to find your referral marketing ROI (whether you’re using the spreadsheet or calculating manually).

Calculating the lifetime value of a new customer

It is widely known in the marketing world that acquiring a new customer is more expensive than retaining your current ones. In fact, one survey confirmed that the cost of acquiring customers has increased by 50%. The longer you retain a customer, the greater their customer lifetime value.

Customer lifetime value (CLV) is defined as the profit a business makes from a given customer, throughout their entire time as a customer.

And referred customers tend to have a higher customer lifetime value than customers who weren’t referred. This means referred customers will buy from your company for longer, and spend more. They are also highly likely to refer other high-value customers, and thus improve your average CLV metrics.

CLV helps companies decide how to allocate their financial resources, what to prioritize, and how much to spend on different aspects that determine customer acquisition and retention.

How do you calculate CLV?

There are three main methods that you can use to calculate customer lifetime value. Let’s explore them together.

Note that, depending on your business model and industry, it can be difficult to get an exact amount of what each customer spent. In these cases, try to get as close of an estimate as possible and refine the number as you continue your referral program.

A. The basic method of calculating CLV

To estimate CLV in the simplest way, subtract the acquisition cost of an individual customer from the revenue your company has earned from that customer.

Total customer revenue – customer acquisition cost = CLV.

B. Calculating customer value and average lifespan

Although this is another estimate of CLV, it’s a bit more accurate than the basic formula.

Step 1: Divide your company’s total revenue over a period of time by the number of purchases made over that period. This will give you the average purchase value.

Step 2: Divide the number of purchases over the period of time mentioned in step 1 by the number of unique customers who purchased during that time period. This will give you the average purchase frequency rate.

Step 3: Multiply the average purchase value by the average purchase frequency rate. This should give you customer value.

Step 4: How many years do you think a customer will buy from your company? This should be the average customer lifespan.

Step 5: Finally, multiply customer value by the average customer lifespan.

This should give you the total average amount that your company can expect to make from a customer – your average customer lifetime value.

C. Using customer lifespan and churn

In another way to calculate customer lifetime value, you’ll start by calculating the average customer lifespan. To do this, begin by calculating your churn rate.

Here’s an example of using churn rate to calculate LTV:

Let’s say that you have 500 customers, and 10 of them cancel subscriptions every month. Then your monthly churn rate should be:

- 100*(10/500)

- 100* (0.02) = 2%

Your monthly churn rate is 2%.

Let’s calculate the Customer Lifetime Value using the churn rate we just found.

In our example, this will be:

- 1/2%(our churn rate)

- 1/0.02 (decimal form of churn rate) = 50

- This gives us an average customer lifespan of 50 months.

Multiply that by the average customer spend per month to get the average customer lifetime value.

- If $15 is the average monthly spend in our example, then we need to multiply 15 by 50.

- 15*50 = $750 = customer lifetime value

Note that the longer a customer buys from your company, the higher the amount of money they will spend.

Calculating the value of your reward

The rewards in a referral program should compensate customers for the effort they put in to make referrals.

Of course, you shouldn’t leave the potential new customer out of things, as rewarding newly referred leads helps increase your program’s customer acquisition rate.

Although the value of the reward should match the effort the individual puts into making a referral or becoming a referred customer, it should also be cost-effective for your business to offer. How to strike this balance? Here’s one way to calculate your ideal reward value.

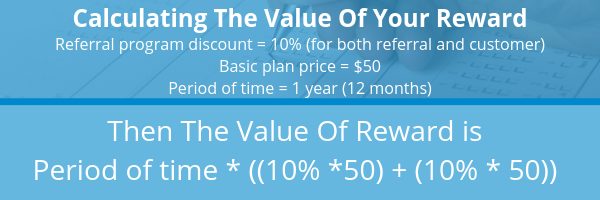

An example of how to calculate the value of your reward

Let’s say that:

- Your referral program gives a 10% discount for customers who successfully refer others

- It also gives a 10% discount for referred customers who purchase

- Your product or service has a basic plan of $50

- Customers buy the $50 plan for one year (12 months)

To calculate the value of your reward, consider both the existing customer and the newly referred customer. Use this formula:

In our example, the above variables should be replaced by:

12* ((0.1*50) + (0.1*50))

12* ((5+5))

12* 10 = 120

$120 is the value of each reward.

Calculating the average value per transaction (AVT)

The average value per transaction can be defined as the average amount that a customer spends in a single purchase. It is seen as an indicator of changes in customer behavior as a result of changes in your marketing strategy, your products, your pricing, or even the season, depending on your niche or industry.

In order to get more useful insights from the average value per transaction, it is best to combine it with your conversion rate: how many people visited your store or site vs. how many people bought from you.

An example of how to calculate the average value per transaction

Divide your total retail sales over a given time period (one day, one week, one month, one quarter, or one year) by the number of transactions over that time period.

For instance, if your monthly retail sales are $250,000, and these are generated from 200 transactions, you will divide the retail sales by the number of transactions to get the monthly average value per transaction (AVT).

250,000/200 = 1250

The average transaction value = $1250 over a period of one month.

In this case, say you start with an average transaction value of $1250 for one month, then change your marketing strategy (such as implementing your referral program). If the AVT changes to $1500 for the first month of the new strategy, you could conclude that the change in marketing strategy was successful.

You can also calculate the overall average value per transaction vs. the AVT for referred customers only during that same time period. If the referral AVT is higher, that’s another sign that your program is returning a positive ROI.

Calculating the transactions per customer for a given time period

The average value per transaction (AVT) estimates how much each customer spent during each transaction made. But how to know how many transactions a particular customer made over a time period, for instance, a year?

We could find this by dividing the average number of transactions made in a year (in the example above, 200*12 or 2,400) by the number of customers you had that year (let’s say you had 600 customers.)

2,400/600 = 4

We could then say that each customer, on average made 4 transactions over a one-year period.

You can then compare this average number of transactions per customer overall to the average number of transactions made by referred customers only, over the same time period. Of course, you’ll need to check the AVT and conversion rate for each group too, for the most accurate picture of how your referral program performed.

Calculating the retention rate

Retention rate is calculated as a percentage of the customers who keep buying from you over a defined period of time, compared to those who churn.

In your referral program, retention rate can be seen as:

- The percentage of existing customers who keep bringing more referrals, and keep buying from you using rewards

- The percentage of referred customers who keep buying from you

To calculate the retention rate of your referral program, there are three factors to consider:

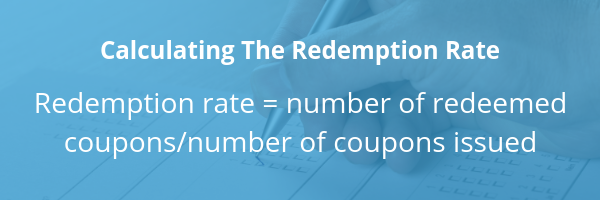

1. Redemption rate:

Checking the redemption rate is important if your referral program is discount or credit based (in other words, if it has rewards designed to be redeemed on a future purchase). Redemption rate refers to the percentage of rewards that are actually redeemed on your website or in your store. The percentage of redeemed rewards is a reflection of happy customers and referral program success.

An example of how to calculate the redemption rate

Feel free to customize this formula based on your reward.

If your redemption rate is less than 20%, you may want to look into your referral program, to determine how effective it is. You may find that customers do actually accumulate credits, but do not use them. If this is the case, figure out what to do to revamp your referral program.

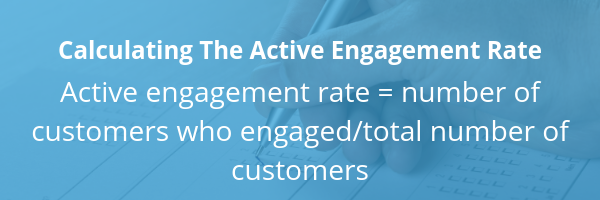

2. Active engagement rate

This metric should be used together with the redemption rate. It shows the percentage of your customers who regularly engage with your referral program. To calculate the active engagement rate, look at customers who have earned or spent the rewards in your store or on your website within a stipulated amount of time.

An example of how to calculate active engagement rate

This metric gives insights into the specific number of customers that are engaging with your referral program and helps you determine your program’s success.

A similar metric that you should look at is the participation rate. We will look at this in detail a bit later.

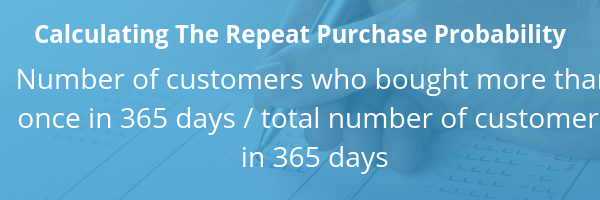

3. The repeat purchase probability (RPR)

RPR can be defined as a percentage of the customers who have purchased more than once. Why would you want to calculate RPR? Because it is repeat customers that keep your business growing.

Repeat customers contribute to 40% of your revenue, on average. Repeat customers are also highly likely to continue using your referral program and bringing in new customers. They are happy customers who will likely tell others about their happy experiences, too. These MVPs will generate more revenue for your business, and give you insights that will help you acquire and retain new customers.

An example of how to calculate RPR

Let’s add numbers.

If the number of customers who bought more than once this year was 300, and the total number of customers your business has in 365 days is 500 (new and existing),

Then RPR is:

300/500 = 60%

You’ll want to compare this overall RPR to the RPR of customers using your referral program, to see if customers using the program are more likely to make repeat purchases.

Calculating turnover rate

Is your referral program continuing to engage customers and encouraging them to keep sharing with friends?

To check how well your referral program is retaining participants, consider the following metrics:

Churn rate

If you recall, we looked at churn rate when we were calculating customer lifetime value.

- In a referral program, the churn rate refers to the number of customers who drop off from your referral program.

- It could also mean the number of customers who do not make repeat purchases after being referred to your program or business.

An example of how to calculate churn rate

To calculate the churn rate, find your initial number of participants in referral program, subtract those who have dropped from your referral program over a period of time, then divide the result by the initial number of subscribers.

Let’s add a few numbers here.

- Initial number of subscribers at the beginning of the month: 500

- Number of customers who dropped off over the month: 75

- 500-75 = 425

- 425/500=0.85

- The churn rate here is 0.85

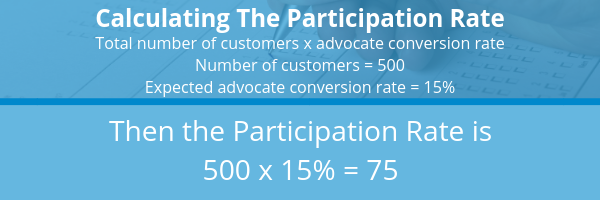

Calculating the participation rate

Participation rate refers to the number of people that have told others about your brand or product via the program, relative to the total number of people that your referral program reaches.

How do you calculate the participation rate?

You need to consider a number of factors:

- Number of contacts in your customer database

- Number of customers served weekly

- Number of reached customers in a specific period of time (weekly, monthly)

- Social media reach

An example of how to calculate the participation rate

If you have 500 customers, and your expected advocate conversion rate is 15%, then the participation rate is:

500 x 15% = 75 customers who participate

The participation rate should give you a rough idea of the number of advocates that will register for your referral program.

Why measure the participation rate? It helps to monitor how well-targeted your referral program promotional strategy is. It also helps to determine the best promotion channels for your referral program to have maximum reach, the quality of your content and calls to action (CTAs), and other program design factors.

Defining what constitutes a conversion

When checking your referral program’s conversion rate, you’ll first need to understand what counts as a conversion. A conversion can be any action that leads you to issue a reward, whether that reward goes to a referring customer or a new customer. Some common types of conversions include:

- Buying your product after they were referred by a friend

- Subscribing to your service after they were referred by a friend

- Referring others who make a purchase (also, check how many referred customers successfully bring in friends of their own)

- Becoming a qualified lead by booking an appointment or demo (in the case of some B2B referral programs)

It is important to note that how you define conversions affects your revenue and profits. More importantly, it needs to be in line with your referral program goals and business goals too.

Calculating the conversion rate

The conversion rate is the percentage of customers who take a specific action, relative to the number of customers who are invited to take the action.

For example, if 5,000 customers are referred in one month and 500 of these customers end up purchasing, your conversion rate is 10%,

Calculating referral program ROI: How much each conversion is worth

We have looked at what constitutes a conversion, and how rewards are given based on the defined conversions. How do you calculate the aggregate amount that can be rewarded on each conversion?

An example of how to calculate the aggregate amount

Let’s say that you have a successful referral program with 300 successful advocates, where each advocate generates 10 referrals (3,000 total people referred).

- The program has a conversion rate of 10%, and thus brings in 300 new customers per year.

- The desired ROI from the program is 5x.

- The program generates a value of $50,000 per year in revenue.

- The maximum amount you’re spending on the referral program is $5,000.

- The LTV is $2000 for each customer.

- The administration cost (cost of running the referral program, including software) is $2,000 per year.

There are several steps to calculate the aggregate amount:

Step 1: Calculate the referral program ROI

50,000/5,000= 10. This means that you’re generating a 10x ROI with the current spending on the program.

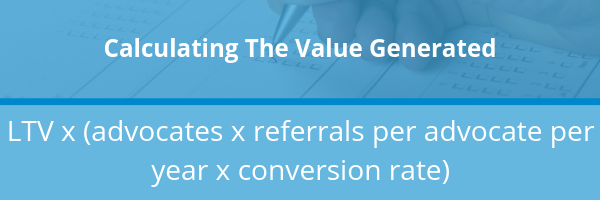

Step 2: Calculate the total value

2000 x (300 x 10 x 0.1) = $600,000. This is the total value you stand to generate from the program.

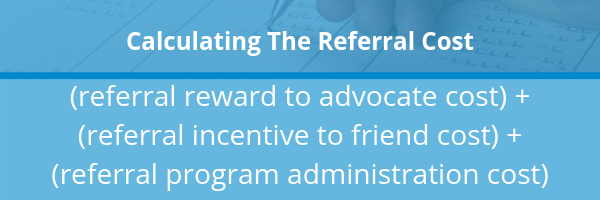

Step 3: Calculate the referral cost

If the referral program generated a value of $50,000 in a year and the desired ROI was 5x, then the maximum annual referral program cost (maximum amount you can spend on your referral program) is:

$50,000/5 = $10,000

If the maximum referral program cost is $10,000

Then: reward for advocate + reward for friend + administration cost of 2000 cannot exceed $10,000 per year

X + y = (referral reward to advocate cost) + (referral incentive to friend cost)

X + y = 10000 – 2000

X + y = 8000

We, therefore, have $8,000 to give advocates and their friends (the people whom the advocates refer) per year.

If there were 300 new customers that resulted from the referral program, you can find the reward value for each advocate and the referral they bring.

$8,000/300 = $26.66 (so, you might give $15 to each advocate per referral, and $10 to each newly referred friend)

Remember, the reward value should match the effort that customers will put into getting you new referrals.

How to reduce and remove program slippage

No referral program is 100% foolproof. Every program will experience at least some slippage.

What is slippage in the context of a referral program? This is when customers seek to benefit from your referral program’s rewards via unauthorized methods.

Examples:

- The same reward code being used over and over

- An existing customer capitalizing on a reward meant only for a first-time customer

- Customers referring themselves

- Customers creating multiple or fake accounts

- Sharing referral links on unapproved sites

- Customers using bots to beat the system

Slippages result in loss of revenue, and less referral program ROI. Worse still, slippage doesn’t bring in new customers.

Reducing and removing slippages

Here are a few ways you can reduce slippage.

Give a reward that is balanced

Your reward should not be too low, as this will not attract many advocates. However, do not give a reward that is extremely valuable, either, as this is one way to attract referral fraud. A balanced reward will make your customers happy enough to bring in more referrals while reducing the number of people who would want to “beat the system.”

Flag IP addresses

You may want to use a click-fraud detection service that detects multiple referral attempts from the same IP address. The fraud detection service will then automatically block fraudulent IP addresses from receiving a reward.

Choose rewards that are not cash-based

Cash-based rewards are highly likely to attract fraudsters. Other reward options, like store credits, are much better as they require a prior relationship with the customer.

Use a reputable referral management software

One of the factors that you need to consider when purchasing referral software is whether it can block fraudulent activity. Choose a software that will stop fraudsters in their tracks, so your referral program ROI will be greater.

Implement cookies

Control the cookie types that you have on your site to prevent people from engaging fraudulent activities within the same tracking cookie session.

Referral program ROI: Key takeaways

Calculating your referral marketing ROI can be a bit hectic, but the insights gained from the process make the process worthwhile. You need to consider each of the factors discussed above:

- Lifetime value of a customer

- Reward value to offer

- Average value per transaction

- Transactions per year per customer

- Retention rate

- Participation rate

- What constitutes a conversion

- Conversion rate

- Aggregate amount that can be rewarded per conversion

- How to reduce program slippage

Interested in learning more about referral program tracking and automation? We recommend these resources: